Predatory lending and special credit card offers designed to lure you in have been topics in the news lately, especially after it was revealed that employees at Wells Fargo were pressured to sign up people for credit cards whether or not they needed – or had the credit- to have them. Credit card offers, too good to be true loans, financial packages that are not clearly explained to you, and special offers that are bait and switch tactics are just some of the areas where scams lurk.This U.S. government website lists the most common scams in the U.S. including: financial

Read more →This week marks mythird season hosting my national radio shows, Fearless Fabulous You! (W4WN.com)and The Connected Table LIVE! (W4CY.com). I created my shows because I wantedto use my voice toshare stories of interesting people and inspire others. The work has been hard but completely gratifying. I’ve met so many wonderful, gifted and giving people along the way, from medical experts to authors to entrepreneurs. I’m still looking for show sponsors and partners and welcome referrals. In the meantime the nicest thing you could for me and for my guests is to pleasetunein and share my shows. LINK TO IHEARTLINK to

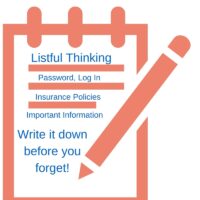

Read more →When my father passed away from cancer in 2009, I remember one of the most frustrating things my mother and I dealt with was getting access to his various accounts and unlocking his mobile phone. We didn’t know the passwords. I have forgotten passwords to numerous accounts. I reset one, carefully file it away and then forget where the file is on my computer. It happens all the time, and I’m still sound of mind. Imagine 20-30 years from now! It’s more than just passwords that you should share with someone you trust. If you become incapacitated at any age,

Read more →With seven best selling books to her name and as Founder/CEO of Motivating the Masses, one of the nation’s only publicly traded personal and business development training companies, Lisa Nichols travels the world to share her wealth of knowledge to teach people how to find their passion and purpose, achieve prosperity and live an abundant life. But there was a time when Lisa had to face the hard reality that she needed to make changes in order to create a better life for herself and son Jelani. Twenty years ago Lisa was a struggling mom living on government assistance jumping

Read more →When I was diagnosed with breast cancer in 2009 I was running a successful wine and food public relations agency, eating at the top restaurants and visiting the world’s great wine regions. Five years later, I came to a point where I considered applying for food stamps. My income was dried up and I was behind on my house payments. How did this happen to me? I learned I was not alone and should not be ashamed. I decided to speak out and learn more. According to a University of Michigan study 25 percent of breast cancer survivors reported financial

Read more →Can you eat on a $4 a day budget? I bet your $4 latte or juice you say you can’t. But $4 isthedaily budget 46 million Americans must survive on to eat, based on the allocation of SNAP, the U.S. government’s food stamps program. And millions more, including cash strapped working parents, fixed income retirees, students and grads entering the workforce, live with similar limitations. We’re talking food and nourishment and the fact that many people don’t have enough on their plates for themselves or their families despite living in a country where food is plentiful. It’s called food insecurity

Read more →According the the websiteNerdWallet.comthe average U.S. household consumer debt profile as of May 2015 is: Average credit card debt:$15,609 Average mortgage debt:$156,706 Average student loan debt:$32,956 In total American consumers owe $11.91 trillion in debt, an increase of 2.5% from last year.I fit into that group as do many others. Certified Public Account and personal financial specialist,Kemberley Washingtonlearned to ditch her debt. Now she helps others make smarter financial management decisions and reduce their debt. Kemberly will discuss ways to manage and reduce your debtMonday, June 8, 9:28pmEST on Fearless Fabulous You!onwww.W4WN.comandiHeart.com and the iHeart App.Kemberley and I are both

Read more →My mother (aka “The Purple Lady”) lives by her “Purple Rules” which means “Do unto others and for others.” Give graciously and generously to help others without expecting anything in return. According to the Women’s Philanthropy Institute at Indiana University Eventhough women, in general, earn less than men, have less in retirement, and outlive their spouses, this study demonstrates that Boomer and older women appear to be more generous in giving to charity than comparable men, when we take these factors into consideration. “Philanthropy” is a big word that you think is applied only to the wealthy (as in a

Read more →With Mother’s Day approaching, I’ve decided to address an aspect of women that is continuing to grow and flourish. It is an ideal that my Mother, Sonia Young, passed on to me…”Do unto others.” Women are drawn to giving and giving back. According to studies conducted by The Indiana University Lilly Family School of Philanthropy: single women are significantly more likely than single men to make a philanthropic gift; female-headed households are more likely than or as likely to give as male-headed households in every charitable subsector; married men and marriedwomen are both more likely to give and to make

Read more →Why are some women more comfortable discussing love, intimacy, diets and stomach bloating but not finances with their spouses? I admit to being one of those women for many years. I think much of it was due to my upbringing where discussing money was not appropriate; neither were religion or politics. Both of my parents worked full time earning decent incomes, but their approach to spending and saving money was not in sync, and I remember as a child listening to their fights over money. Perhaps that’s why I clammed up over money talk with my intended husband. I am

Read more →Facebook COO Sheryl Sandberg may have redefined “Leaning In” in her best selling book but my guest January 26 on Fearless Fabulous You! defines theconcept of “Lifting Up,” as in mentoring, community service and using her expertise to engage and enlighten women about finance, careers, self-sufficiency and philanthropy, Linda Descano, CFA®, is Managing Director and Head of Content and Social at Citi, responsible for social media and content marketing efforts for Citi’s Global Consumer Bank. Over her 20 years at Citi, Linda has held a number of roles across different businesses and functions. She joined Citi predecessor Salomon Inc. in

Read more →I had plastic surgery last week. l cut up my credit cards.–Henny Youngman I’ve decided to give up using credits cards this winter. I froze my credit. I placed my cards in a plastic storage bag and put them in the freezer away from my hot hands. I’ve decided to nip and tuck my expenses and rethink what “living within my means” actually means. Doing this is no mean feat. I think living in New York has given me a warped sense of what “my means” and “my needs” actually are. Many of us start feeling a financial pinch when

Read more →